The Chancellor’s budget is urban-centred, will hit small businesses hard, potentially threatens the future of small family farms across the region, has nothing for the south west and fails to address many long-standing concerns, says North Dorset MP Simon Hoare.

‘Where long-term change was wanted, the Chancellor has offered ‘timidity and sticking plaster,’ he told the BV Magazine.

He welcomed additional funding for local government and education, particularly for the hard-pressed SEND (special educational needs and disabilities) sector, as well as the freeze on fuel duty, and a penny off a pint. But overall he believed Wednesday’s budget would result in a delay to the hoped-for fall in interest rates and inflation.

Mr Hoare accused Chancellor Rachel Reeves of making ’a malicious and reckless smash and grab raid on the small business sector and entrepreneurs.’ Examples of the damage being done to small business included the increase in National Insurance contributions and the minimum wage, while rising bus fares would hit students, people going to work or patients with hospital appointments. ‘It is a budget that is entirely ignorant of the needs of businesses, and of rural businesses in particular,’ he says. ‘The impact on independent schools of not only the imposition of VAT but removing business rate relief amounted to a tax on learning, a retrograde step that would threaten particularly small rural prep schools.’

Overall, Mr Hoare’s verdict was that there was an ‘Orwellian’ edge to the budget: ‘It seems to be saying public sector good, private sector bad. But you can only have good schools and hospitals and strong defences when you have a flourishing private sector as well.’

There was no indication of the root and branch changes that were needed to local government and council tax, but he welcomed new money for social care. ‘I will press the case that the Treasury needs to take on the additional costs of delivering the service in rural areas. They were always sympathetic to this in opposition,’ he added.

The budget is rurally ignorant.

The changes to inheritance tax have rung alarm bells across the region. Simon Hoare said it would ‘sound the death knell of small family farms that play such an important role in North Dorset, West Dorset and Somerset. The budget is rurally ignorant.’

Social media was immediately full of concerns from the rural community about the impact of a 20 per cent tax on property worth more than £1 million. The average Net Farm Income for a farm grazing livestock is £23,000 (a quarter of farms in Great Britain failed to make a profit last year*), on a farm worth perhaps £3 million. The Inheritance Tax bill on that farm will now be £400,000.

Among the strongest comments was an immediate response from the NFU social media accounts:

‘In 2023 Keir Starmer looked farmers in the eye and said he knew what losing a farm meant.

Farmers believed him.

After today’s budget they don’t believe him any more.’

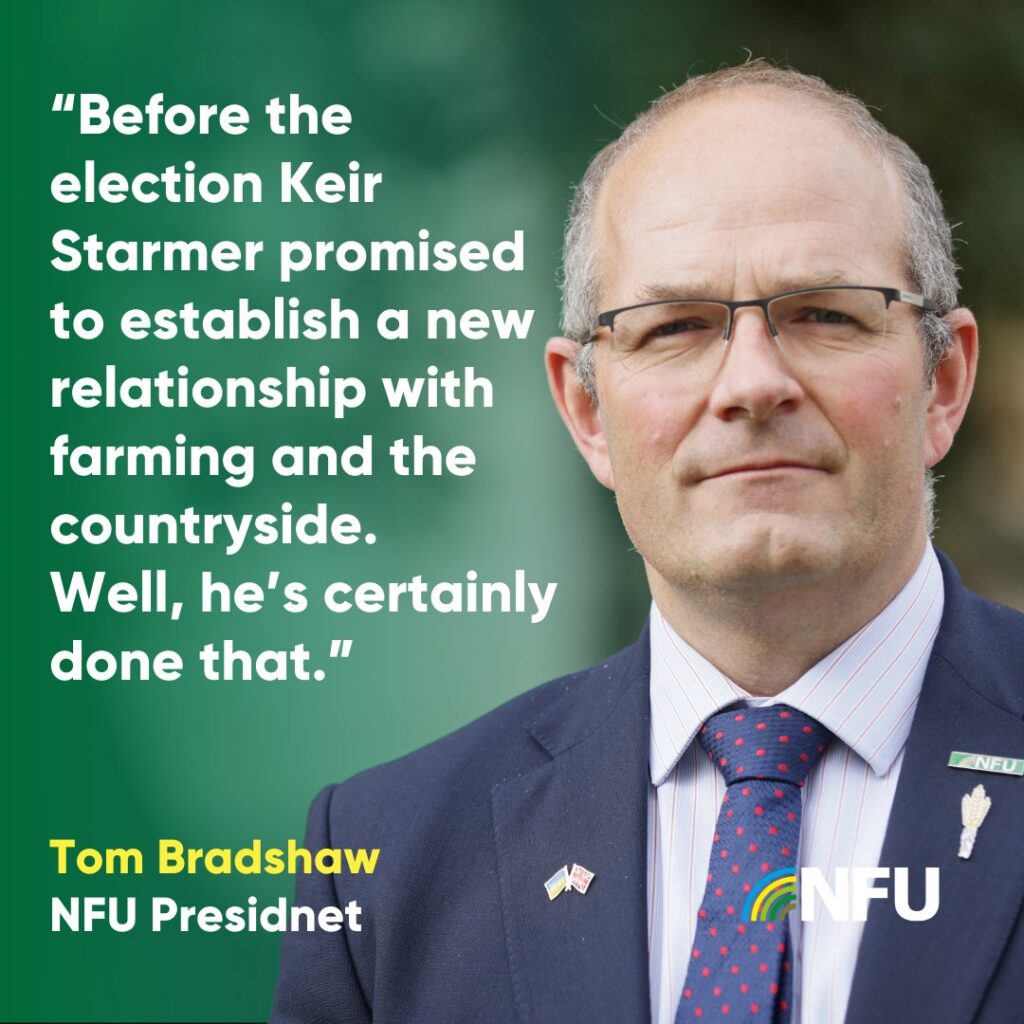

In response to the Budget, NFU President Tom Bradshaw released a statement on what it means for British farmers:

‘This budget not only threatens family farms but also makes producing food more expensive, which means more cost for farmers who simply cannot absorb it and it will have to be passed up the supply chain or risk the resilience of our food production.

‘It’s been a disastrous budget for family farmers, and especially tenant farmers. The shameless breaking of clear promises on Agricultural Property Relief will snatch away the next generation’s ability to carry on producing British food, plan for the future and shepherd the environment.

‘It’s clear the government does not understand, or perhaps doesn’t care, that family farms are not only small farms, and that just because a farm is a valuable asset it doesn’t mean those who work it are wealthy.

‘This is one of a number of measures in the budget which make it harder for farmers to stay in business and significantly increase the cost of producing food.”

‘Before the election Keir Starmer promised to establish a new relationship with farming and the countryside.

‘Well, he’s certainly done that.’

Ian Girling, chief executive of Dorset Chamber, said many businesses in Dorset would have concerns about the Budget: ‘There is some comfort for small businesses with employment allowance increases for National Insurance, but rises in employer National Insurance contributions and the minimum wage mean that employment costs are significantly increasing.

‘This comes at a time when wages have been pushed up by significant recruitment challenges for businesses. It is highly likely this will impact on recruitment, which will have a knock-on effect in terms of future business growth.’

Mr Girling said it was encouraging to see a focus on affordable housing, ‘as this is a barrier to growth for businesses, but I am not sure that it is enough. Economic growth projections over the next three years are very low, which hardly inspires confidence among businesses and consumers.’